At the moment, we're hearing more and more about the blockchain, NFTs, tokens… In the wake of Sorare's spectacular funding round ($680 millions) a few weeks ago, it's time for a closer look. If it all seems unfamiliar, don't worry. We decided to ask a few questions to Yoann Lopez, who created the Snowball newsletter in March 2020 (17,200 subscribers) and often discusses the blockchain, along with more general personal finance issues. Together, we tried to define what the blockchain is and talked about cryptocurrencies, especially the prospects they offer the sports world.

C: Hi Yoann! First, thanks for taking the time to answer our questions. The blockchain is a fascinating but really broad subject so I'm glad to be talking about it with you. Your newsletter Snowball is a hit in France, you mainly talk about personal finance in it, and what I like most about it is your very educational approach. I think that's exactly what we need when approaching this world.

I'd like to start with the basics and look at 3 concepts together, 3 words we often use when talking about this topic: the blockchain of course, crypto and NFTs. Can you define them for me?

Y:Hi Chloé! Indeed, it's worth spending some time on this.

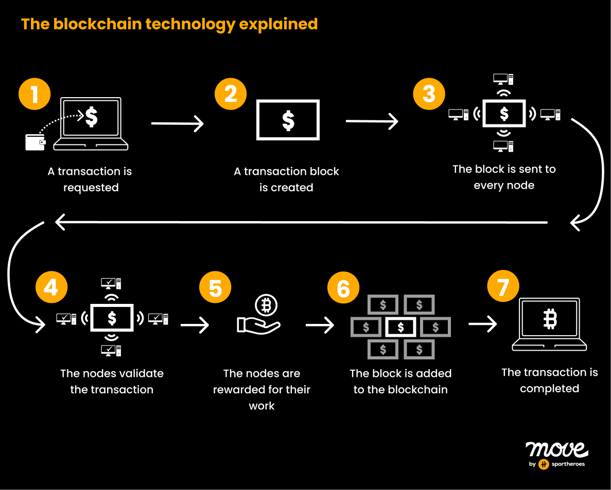

So we'll start with the blockchain. It's complicated when you go into the technical details but fairly simple from a theoretical point of view. The blockchain is like a ledger that you write in without being able to erase or overwrite anything. We have data stored on a chain that can't be erased or overwritten. This is how you can be sure all the transactions recorded are genuine: if it's written down, it must be true. The key thing to remember about the blockchain is its 4 main principles: transparency, security, traceability and decentralisation.

The blockchain is based on crypto(graphy), which is used to encrypt messages with the help of mathematical algorithms. It protects users' identities and keeps the information secure. So to validate a transaction in this ledger, we have computers (called miners) working to perform cryptographic calculations and validate transactions. Each time they validate a transaction, they are rewarded with the cryptocurrency of the blockchain in question.

So that's how the blockchain works, put very simply.

And there are multiple blockchains like that. The most famous is of course BITCOIN, as it was the first. ETHEREUM is also very well-known. These are two different blockchains, two different networks. Each blockchain has its own "currency" called cryptocurrency (sometimes even several of them). So on ETHEREUM, we have the main cryptocurrency which is ETHER (ETH) and other tokens that live on top of that blockchain.

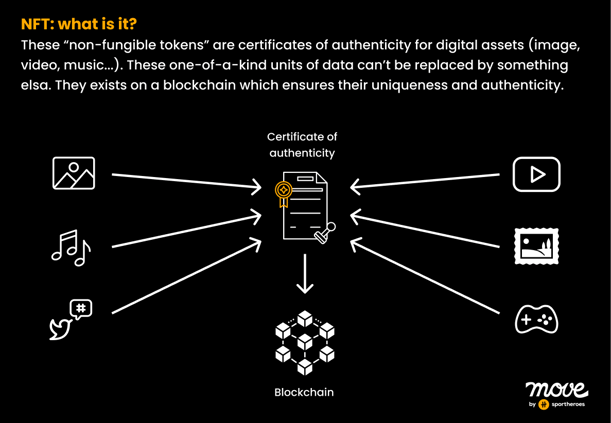

By tokens, we mean exchangeable digital assets. These tokens include NFTs (Non-Fungible Tokens). An NFT is an item of data stored on the blockchain. It can be any kind of data: a picture, a tweet, a video, art… it can be a recording of a sports event. Anything you like, basically. This NFT lives at a specific location on the blockchain. The advantage is that the blockchain guarantees its uniqueness because you can retrace its path from the moment it was created (the ledger that can't be erased or overwritten). Take the Mona Lisa for example: there are lots of copies in existence, but we're sure the one at the Louvre is the original as it's been validated by experts, it's unique and lives on that canvas Leonardo da Vinci used. In the case of the NFT, the experts are the blockchain and its miners: they validate the fact that this NFT is original and unique. That's what makes this world interesting: you can create rarity where there previously was none. So that's NFTs, in a few words…

C: Can you explain how NFT works? In concrete terms, if I want to buy one tomorrow, how do I go about it?

Y: Well, it's a bit complicated because there are many ways to buy an NFT but we'll look at the most common way! You go to an NFT selling platform. A bit like going to Amazon to buy a new product. Here, you go to a marketplace like OpenSea and Rarible. You'll find NFT sellers there. Either you buy NFTs at a fixed price, or you bid in an auction. Because they're rare products, it is usually an auction. You buy your NFTs with a cryptocurrency like ETHER. You get ETHER simply by converting your euros via a platform like Coinbase or Binance, then transferring it to a Ledger or MetaMask wallet (digital wallets). Once you win your auction, you own your NFT and it's transferred to this wallet, the one where you keep your cryptocurrencies. Now, there are also more and more NFT platforms that are trying to make this world more accessible, such as Sorare. They allow users to pay directly with their bank card in euros, without using wallets. But watch out, these platforms store your NFTs and if there's a problem (hack, bug, etc.) you might lose them. Private wallets are generally more secure than storage on crypto platforms.

C: Precisely, and we'll come back to the topic of Sorare and these other blockchain-based businesses in a while. But first, what connections are possible between the blockchain and the sports industry?

Y: In my opinion, they can be connected in several ways. First, at individual level, we have talented and really well-known athletes whose only way to monetise their fame, as things stand, is to be hired by a team for a huge sum or be paid by sponsors and do advertising. I think the world of NFTs gives power back to the athletes themselves because it enables them to connect directly with their fans and find a new way to earn money. They can create their own NFTs and sell them to their fans. Some are already doing it.

Institutions like clubs can use NFTs to create a stronger connection with their supporters, in a more fun way. Until now, you had supporters who watched matches, cheered for their teams, bought shirts and that was it. They might have had a season ticket at the stadium but it didn't go beyond that. Now, you have supporters who can become "shareholders" in the club by buying NFTs. Their votes count, they might even take part in decision-making if the club has a system in place for that. That's what's happening with Socios.

C: Indeed, there are quite a few examples of sports-related NFT businesses now. For the NBA, there's a marketplace called NBA Top Shots (DapperLabs) where you can sell, buy and trade "moments" from games. In short, you become the owner of an official video and that moment (a dunk for example) belongs to you, in a way. There's also Sorare, which we're hearing a lot about at the moment because they've had a huge funding round ($680 million). To put it in a slightly caricatured way, Sorare is a cross between Panini cards and fantasy football. You have digital cards depicting players that you sell and trade. And the users who own these cards play against each other.

Y: Exactly. And you have cards that are more or less rare: some cards are unique, others are available in 10, 100 or 1,000 copies. The game is based on the value of the card, which is linked to the performance of the player and his club, and on this phenomenon of rarity.

C: That's how an NFT card of C. Ronaldo came to sell for $289,920. Then you have Socios and its "be more than a fan" promise. This company is very much in the news and has even become an official partner of Inter Milan. Simply put, you buy your favourite club's cryptocurrency to become a shareholder in the club.

Y:That's right, rather than buying a share, you buy the club's cryptocurrency. You can be more active in the club's life, take part in decision-making.

Today, it's mainly clubs that have invested in the blockchain world, but tomorrow I imagine there will soon be new businesses focused on the individual, the athlete. Messi could have his own tokens! For example, there's tryroll which offers social tokens, NFTs based on your identity. So I, Yoann, can have my own token. And there, the possibilities are endless. I can decide that if someone buys 10,000 Yoann tokens, they are entitled to have a coffee with me. So I can imagine athletes having a direct relationship with fans in this way. In fact, in the USA, some NBA players (like Spencer Dinwiddie) have already done this. Although it hasn't really developed yet.

C: So the clubs have picked up on the trend, and you're saying players will too in the future. Do you think other parties involved in sport, like the media or sponsors, could do the same thing?

Y: NFTs work as soon as a community exists. You can use NFTs as a membership card that gives you access to a select circle. For the media, I could see Amazon Prime selling French Ligue 1 highlights, like DapperLabs does. The French sports news media L'Équipe could also create NFT collections like TIME Magazine has done (Editor's note: TIME auctions its iconic front pages as NFTs). TikTok has also joined in: it teams up with content creators to sell TikTok Top Moments and thus enable these creators to earn money.

For sponsors, associations with athletes are more likely: just like they make clothing ranges in partnership with the athletes they sponsor, they could co-create an NFT collection. That would enable the sponsor to make money in a totally different way

C: Indeed, the prospects are extremely interesting. One last question about the blockchain universe: what about web3? What does that have to do with all this? And why is it seen as the next big internet development?

Y: For web3, it's quite easy to understand. Today, we're still in the web2 era: the internet lives on its own specific network and we have email apps, banking apps etc. that live on the internet. It's all very centralised and most platforms are controlled by a few companies on top of which other companies are built (for example, many businesses exist thanks to Apple's App Store or Amazon's Cloud). Tomorrow, in the web3 era, these same email, banking or gaming apps will be able to live on the blockchain in a decentralised way. And users will be able to own and control their own data. It's already happening, in finance in particular. It's what we call decentralised finance (DeFi): there are no more intermediaries. But it could happen in all areas! What's interesting is the authenticity and truthfulness that the blockchain makes possible. The other benefit of web3 is that these apps built on the blockchain can rely on thousands of different machines (supercomputers). So logically, what happened in early October, when Facebook, Instagram and WhatsApp went down for hours, should no longer be able to happen.

C: To round off this interview, and because the blockchain world is really vast and still not very accessible, what's your advice for people who want to learn more about the subject? Where should they begin?

Y: Actually, a Snowball reader has created a really interesting media feature about NFTs: NFT Evening. Otherwise, the best way is to try it out! You can start with Sorare as it's a really simple platform. It's a first step in the blockchain world.

Key points

- The blockchain technology is based on 4 main principles: transparency, security, traceability and decentralisation.

- NFTs are unique digital assets that can't be replaced with something else. They can be anything: a visual, a piece of art, a tweet, a video, a sound, a video game accessory... Their uniqueness creates rarity in the Internet.

- Decentralisation that applies to blockchain can be reproduced in the world of sports: we can build a more direct and authentic relationship between athletes or clubs and their fans. Thanks to NFTs and cryptocurrencies, new powerful experiences can be created to engage communities.

- We can consider an NFT as a member card which gives access to an exclusive club with exclusive content. This is a new way for brand, media and organisations to strengthen the sense of community.

About Yoann Lopez: After studying economics at university, Yoann entered the start-up world by joining Withings. Four years later, he attended Le Wagon and ended up at Comet, a marketplace that puts freelancers in touch with companies. Always passionate about economics, finance and tech, he takes a keen interest in the blockchain world and launched the Snowball newsletter in March 2020. What began as a side project has now become his main occupation. 17,200 people have now subscribed to this personal finance newsletter, which is available in a free version or a paid version for a premium experience (access to a mobile app, reports…). And he has a book coming out soon.